Nov 27 2012

Housing: The Little Engine that Could

Posted in News

No Comments

Posted on: November 27, 2012

By Frank Anton

A weak housing market often gets blamed for the Great Recession as well as the anemic economic recovery.

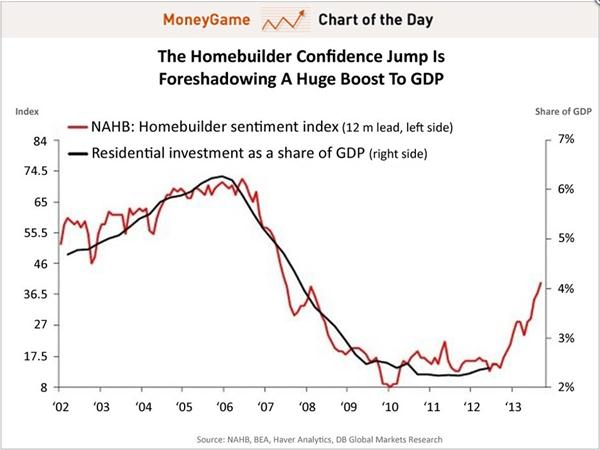

But, if the pattern portrayed in the accompanying chart holds, housing should, as it always has, come to the

economy’s rescue.

With NAHB’s Home Builder Sentiment Index at 47 (the highest level since 2006), it’s reasonable to assume

that housing’s contribution to GDP should move back to its traditional average of about 5%. That percentage

was as low as 2.5% in 2010, when the Index was at 8, an all-time low, and it was as high as 6.2% when the

Index peaked at about 75 in 2006.

Economists now see housing generating up to 20% of overall GDP growth in QIV 2012. GDP growth means jobs;

jobs mean a stronger housing market; and that means more jobs and so on and so on, which means the end of

the vicious economic cycle triggered by housing’s collapse and the real start of a robust recovery.

Featured Properties

361 Almont Beverly Hills CA 90211 $ 3,695,000.00

TWO-STORY FRENCH MEDIT. 4 BDMS 4.5 BATHS, GOURMET KITCHEN, HOME SITUATED BEHIND WROUGHT-IRON GATES. SWEEPING OAK STAIRCASE LEADS TO SECOND STORY. A/C, SEC., HDWD FLRS, BUILT-IN VACUUM CLEANER, HUGE MASTER WITH MAGNIFICENT CLOSETS. FP IN LR AS WELL AS FRM. OPENING TO NICE-SIZED REAR GARDESN. WALK TO EVERYTHING. PARKS, TRIANGLE, SCHOOLS, HOUSES OF WORSHIP. THIS…

418 Elm Beverly Hills CA 90212 $ 3,695,000.00

Grand Mediterranean Estate with a luxurious open floor plan located on a prime southern BH street. Formal entry with soaring ceilings to living and dining room. Exceptional custom chefs kitchen with top grade appliances that opens to an enormous den and private backyard with lush landscaping. Designer staircase leads you to four en suite bedrooms…