Nov 27 2012

Housing: The Little Engine that Could

Posted in News

No Comments

Posted on: November 27, 2012

By Frank Anton

A weak housing market often gets blamed for the Great Recession as well as the anemic economic recovery.

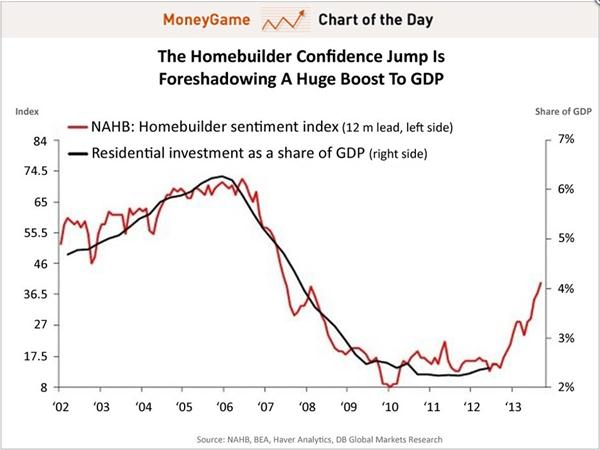

But, if the pattern portrayed in the accompanying chart holds, housing should, as it always has, come to the

economy’s rescue.

With NAHB’s Home Builder Sentiment Index at 47 (the highest level since 2006), it’s reasonable to assume

that housing’s contribution to GDP should move back to its traditional average of about 5%. That percentage

was as low as 2.5% in 2010, when the Index was at 8, an all-time low, and it was as high as 6.2% when the

Index peaked at about 75 in 2006.

Economists now see housing generating up to 20% of overall GDP growth in QIV 2012. GDP growth means jobs;

jobs mean a stronger housing market; and that means more jobs and so on and so on, which means the end of

the vicious economic cycle triggered by housing’s collapse and the real start of a robust recovery.

Featured Properties

336 LA PEER Beverly Hills CA 90211 $ 5,495,000.00

Exquisite! This 3-Story Architectural NEW CONSTRUCTION home features nearly 6000 sf of refined elegance. A property that encompasses ultimate personalization created for someone as individual as you. Inspired by the modernization movement featuring an open floor plan, a free facade, custom Fleetwood banded windows, floating columns and sun drenched pool terrace. Exceptional space planning proffers…

12001 CREST Beverly Hills CA 90210 $ 5,495,000.00

Reminiscent of a house in the Cote d’Azur! Recently remodeled French Mediterranean, located in the Coveted Enclave “The Summit” a 24/7 guard-gated community in Beverly Hills. Fantastic floorplan throughout. Enter into a two Story foyer with a floating staircase, a sumptuous formal Living Room with a beautiful stone fireplace, a family room with a bar…