Nov 27 2012

Housing: The Little Engine that Could

Posted in News

No Comments

Posted on: November 27, 2012

By Frank Anton

A weak housing market often gets blamed for the Great Recession as well as the anemic economic recovery.

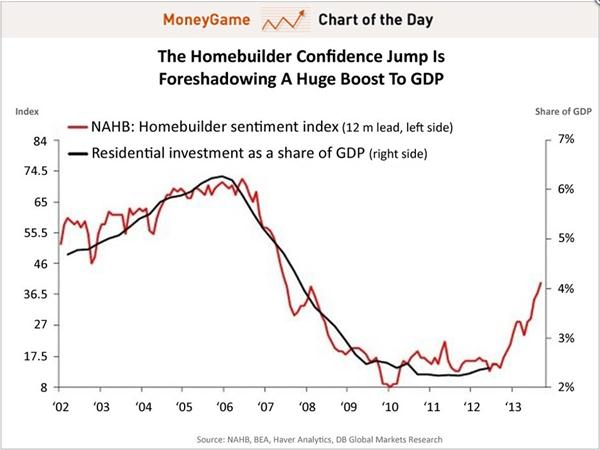

But, if the pattern portrayed in the accompanying chart holds, housing should, as it always has, come to the

economy’s rescue.

With NAHB’s Home Builder Sentiment Index at 47 (the highest level since 2006), it’s reasonable to assume

that housing’s contribution to GDP should move back to its traditional average of about 5%. That percentage

was as low as 2.5% in 2010, when the Index was at 8, an all-time low, and it was as high as 6.2% when the

Index peaked at about 75 in 2006.

Economists now see housing generating up to 20% of overall GDP growth in QIV 2012. GDP growth means jobs;

jobs mean a stronger housing market; and that means more jobs and so on and so on, which means the end of

the vicious economic cycle triggered by housing’s collapse and the real start of a robust recovery.

Featured Properties

9575 Lime Orchard Beverly Hills CA 90210 $ 7,700,000.00

In the guard gated celebrity enclave of Hidden Valley, tucked behind pvt gates in the most well-appointed location, rests this immaculately updated Traditional estate. Double doors draw you into a refuge of flowers, lush lawn, pool, lounge areas & gorgeous landscaping. The entry flows into inviting, spacious living rm w/ FP & French doors leading…

3201 Coldwater Canyon Beverly Hills CA 90210 $ 7,950,000.00

As featured in Architectural Digest, this modern estate sits on approximately 2 acres accessed via a private gated drive and nestled in the most breathtaking setting. Mature trees and an unbuilt canyon surround 3 modern structures overlooking the entire valley. The main home features dramatic 16′ ceilings, expansive windows offering beautiful natural light, and views…