Nov 27 2012

Housing: The Little Engine that Could

Posted in News

No Comments

Posted on: November 27, 2012

By Frank Anton

A weak housing market often gets blamed for the Great Recession as well as the anemic economic recovery.

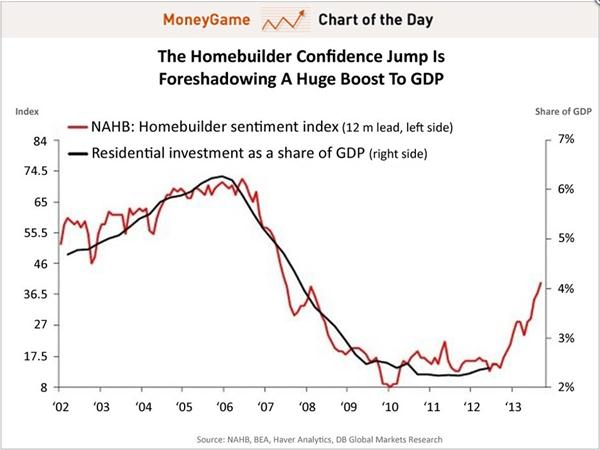

But, if the pattern portrayed in the accompanying chart holds, housing should, as it always has, come to the

economy’s rescue.

With NAHB’s Home Builder Sentiment Index at 47 (the highest level since 2006), it’s reasonable to assume

that housing’s contribution to GDP should move back to its traditional average of about 5%. That percentage

was as low as 2.5% in 2010, when the Index was at 8, an all-time low, and it was as high as 6.2% when the

Index peaked at about 75 in 2006.

Economists now see housing generating up to 20% of overall GDP growth in QIV 2012. GDP growth means jobs;

jobs mean a stronger housing market; and that means more jobs and so on and so on, which means the end of

the vicious economic cycle triggered by housing’s collapse and the real start of a robust recovery.

Featured Properties

16757 Old Guejito Grade Road Escondido CA 92027 $ 25,000,000.00

720 ALTA Beverly Hills CA 90210 $ 25,950,000.00

720 N. Alta is a classically styled European estate set on two-thirds of an acre in the coveted Beverly Hills Flats. This impeccably designed home is poised for exceptional indoor and outdoor entertaining and bordered by cyprus trees and tall hedges, adding to its exclusive, ultra-private atmosphere. The 7-bedroom, 14-bath home boasts sumptuous decorative details…

1012 HILLCREST Beverly Hills CA 90210 $ 25,995,000.00

PROPERTY OFFERED FULLY FURNISHED. Warm Modern Masterpiece set on an over 31,000 sq.ft. lot in prime lower Trousdale Estates w/beautiful city views. Built in 2016, this property offers epic scale w/high ceilings, open spaces & walls of glass that disappear & blur the lines between the indoor & outdoor spaces. Situated behind private & discrete…