Nov 27 2012

Housing: The Little Engine that Could

Posted in News

No Comments

Posted on: November 27, 2012

By Frank Anton

A weak housing market often gets blamed for the Great Recession as well as the anemic economic recovery.

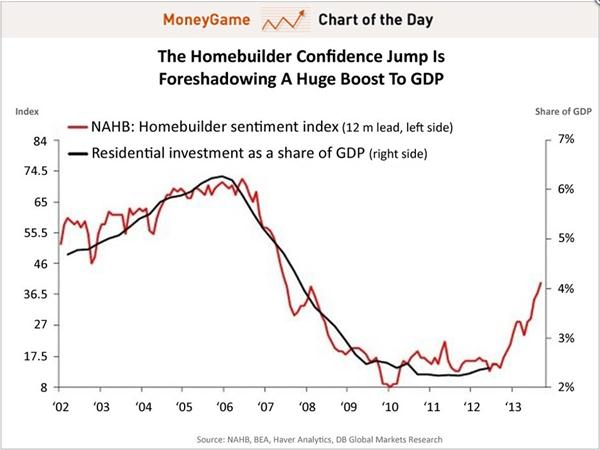

But, if the pattern portrayed in the accompanying chart holds, housing should, as it always has, come to the

economy’s rescue.

With NAHB’s Home Builder Sentiment Index at 47 (the highest level since 2006), it’s reasonable to assume

that housing’s contribution to GDP should move back to its traditional average of about 5%. That percentage

was as low as 2.5% in 2010, when the Index was at 8, an all-time low, and it was as high as 6.2% when the

Index peaked at about 75 in 2006.

Economists now see housing generating up to 20% of overall GDP growth in QIV 2012. GDP growth means jobs;

jobs mean a stronger housing market; and that means more jobs and so on and so on, which means the end of

the vicious economic cycle triggered by housing’s collapse and the real start of a robust recovery.

Featured Properties

1426 Summitridge Beverly Hills CA 90210 $ 46,500,000.00

The Summitridge Estate, an iconic brand new Contemporary estate designed by international designer Troy Adams, which took over 7 years to complete, situated on a one acre hilltop peninsula with jetliner views from downtown to the ocean. Featuring over 21,000 sf of indoor and outdoor living spaces and rooftop terraces. 5 star resort-like living throughout…

1441 Angelo Beverly Hills CA 90210 $ 95,000,000.00

The Enchanted Hill, a 120 acre undeveloped site in Beverly Hills, offers a rare opportunity to develop a single-family compound with multiple guest homes, a state-of-the-art fitness and wellness center, an entertainment complex, a sports arena, world-class equestrian facilities and winery or to subdivide and redevelop as Beverly Hills’ greatest modern gated community with the…